Bitcoin developments (November 2018)

Bitcoin developments (October 2018)

October 14, 2018

Bitcoin developments (April 2019)

April 4, 2019Is Bitcoin doomed?

The price of Bitcoin keeps going down. Is Bitcoin doomed? To answer this question we have to look at the fundamentals: is the Bitcoin still being used and is are there positive developments in the Bitcoin scene?

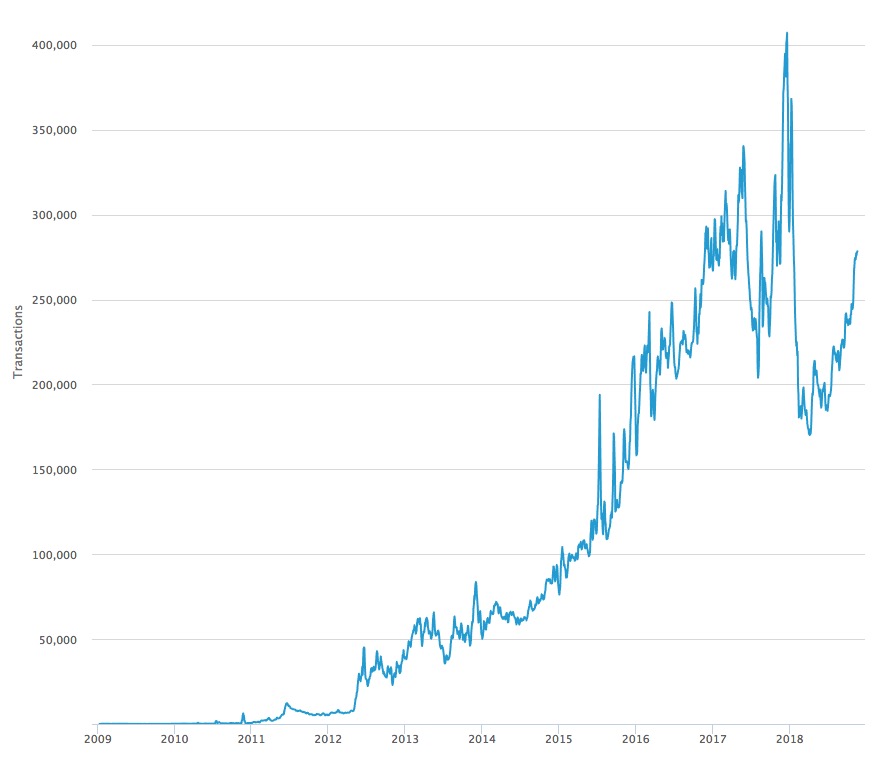

To see if Bitcoin is still being used we can take a look on the number of daily transactions on the blockchain. In the graph below you can see that this number took a dive down after the crash in january 2018, but is now again climbing up. Transaction fees are low again so it’s relative cheap to do transactions on the blockchain.

We further see that there are two positive developments in Bitcoin:

- More and more financial institutes are starting new financial instruments tied to Crypto (including Bitcoin). This enables large institutional investors to invest in Bitcoin and will cause a growing demand and price rice for Bitcoin.

- The Lightning Network is currently in development and it’s usage is growing. The Lightning Network can potential be a replacement for all bank and creditcard transactions because it’s cheaper, faster and more secure. When more and more people start using lightning payments, the demand for Bitcoin will increase.

Some of bitcoin developments are highlighted in this blog post below.

So the future of Bitcoin looks bright. Why is the price of Bitcoin then still going down?

On top of the long term fundamentals there is also a lot of short term trade and emotion in the market. Here is a good video from Alessio Rastani explaining the short term trends of the Bitcoin price. Although Alessio is still very bullish (read positive) on the long term potential of Bitcoin he is predicting an ongoing short term trend going down based on market forces.

Video: How Low Will Bitcoin Go?

Switzerland Green Lights World’s First Crypto ETP

The world’s first crypto Exchange Traded Product (ETP) is to start trading next week on Europe’s fourth biggest exchange, SIX Swiss Exchange, with a market capitalization of $1.6 trillion. A crypto startup, Amun AG, has been given the green-light to list an index fund on a traditional stock exchange.

The Amun ETP will give institutional investors that are restricted to investing only in securities or do not want to set up custody for digital assets exposure to cryptocurrencies. It will also provide access for retail investors that currently have no access to crypto exchanges due to local regulatory impediments.

They plan on launching an index basket ETP first; it allows investors to simply ‘buy the market’ rather than trade specific crypto assets. In the future they plan to launch specific trackers for each asset

The fund automatically allocates crypto distributions based on their performance in market cap rankings. When you buy the stock, market makers buy the equivalent amount of cryptos – according to the distribution – and send it to a custodian for safe keeping.

How does this effect Bitcoin? Large institutional investors are now able to invest in Bitcoin via the Amun ETP. The Amun ETP will buy the Bitcoin for them on public exchanges. This can potentially have a huge positive impact on the Bitcoin price. Lets see what happens the coming months.

Growth of Lightning network

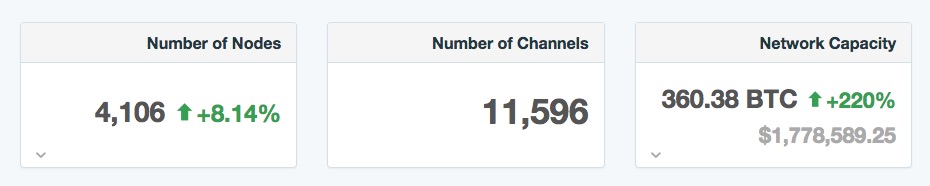

The Lightning network, which makes it possible to to send small amounts of Bitcoin instantly between two wallets, keeps growing. The network capacity has increased above 1.7 million dollar. Also the number of nodes keeps growing making the network more robust en decentralized.

How does this effect Bitcoin? The lightning network can potential be a replacement for all bank and creditcard transactions because it’s cheaper, faster and more secure. When more and more people start using lightning payments, the demand for Bitcoin will increase. This will cause the price of Bitcoin to increase. Until now Bitcoin is mainly used as store as value and not for medium as exchange because transactions in Bitcoins are to expensive for small amounts. The Lightning Network will change this because Lightning transactions are fast and very cheap.

Source: https://1ml.com/

Fake Trezor One devices spotted

In recent weeks, SatoshiLabs has discovered Fake Trezor One devices on the market. Manufactured by a different, unknown vendor.

While Trezor clones are marketed under a different name, manufactured by (legitimate) legal companies, allowing you to distinguish them from the original, a fake Trezor tries to replicate the original to the bone. It seeks to be as indistinguishable from the original as possible. It is not dissimilar to counterfeit brand clothing.

Similarly to clothing fakes, a fake Trezor One is often sold at a steep discount. This should act as the first red flag. More importantly though, let’s have a look at why fake Trezor devices can be a severe threat to your security. As SatoshiLabs did not manufacture the device, SatoshiLabs cannot guarantee its function. These fake devices are thus unsuitable for secure storage of cryptocurrencies and other digital assets. Here is their statement:

“You would not entrust your money to somebody who has already cheated you by selling you a different product than you thought you were buying. We, therefore, recommend not to use this device and report it to us, which would help us fight these scams and provide you with a legitimate device.”

Our tip: Only buy Trezors directly from the official website https://trezor.io/

More info: https://blog.trezor.io/psa-non-genuine-trezor-devices-979b64e359a7

China Lifts Bitcoin Ban; Individuals and Businesses Can Now Own Cryptocurrencies Legally

Bitcoin (BTC) is now recognized as a legal asset to be owned, transferred and utilized as a medium of payment for goods and services in China as decreed by the Shenzhen Court of International Arbitration after ordering the Bitcoin ban in 2017.

Nearing the end of last year, Bitcoin and cryptocurrency trading as a whole was banned by the Chinese government. This was effected by a forceful shutdown of cryptocurrency exchanges based in China including popular Chinese exchange platforms like BTC China and Via BTC.

Virtual currencies have now been legalized in China as a mode of payment to be accepted by people and business entities as. The Shenzen Court of International Arbitration was quoted as saying;

“Chinese court confirms Bitcoin is protected by law. Shenzhen Court of International Arbitration ruled a case involving cryptos. Inside the verdict: CN law does not forbid owning & transferring bitcoin, which should be protected by law because of its property nature and economic value.”

How does this effect Bitcoin? China is a huge market. Now China has lifted the Bitcoin ban more Chinese people can start using Bitcoins for financial transactions. Combined with the potential of Lightning Network this can cause a large demand increase for Bitcoin.

JPMorgan Admits Cryptocurrencies Could Disrupt Banks

The firm made this admission in its annual report, filed with the US Securities and Exchange Commission (SEC).

Deep in the 301-page document, JPMorgan — which manages $2.53 trillion in assets according to recent estimates — listed cryptocurrencies and peer-to-peer technology as potential disruptors to financial institutions and payment processors.

“Furthermore, both financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation,” the bank wrote in the filing. “New technologies have required and could require JPMorgan Chase to spend more to modify or adapt its products to attract and retain clients and customers or to match products and services offered by its competitors, including technology companies.”

Notably, the report was signed by JPMorgan CEO Jamie Dimon, a noted Bitcoin skeptic who has repeatedly lambasted the flagship cryptocurrency as a “fraud” and once threatened to fire any employees caught trading cryptoassets, although he recently walked back some of these comments.

How does this effect Bitcoin? Until now large banks like JPMorgan ridiculed Bitcoin to be fraudulent and unimportant. It seems that they now start seeing that Bitcoin and other cryptocurrencies are here to stay and will disrupt their business.

More info: https://www.ccn.com/dont-tell-jamie-jpmorgan-admits-cryptocurrencies-disrupt-banks/